Prevailing Wage Log To Payroll Xls Workbook : Salary Sheet Template Download Printable PDF | Templateroller - Prevailing wage log to payroll xls workbook / 2 :

Prevailing Wage Log To Payroll Xls Workbook : Salary Sheet Template Download Printable PDF | Templateroller - Prevailing wage log to payroll xls workbook / 2 :. What are the procedure for esi non implemented area. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. Prevailing wage log to payroll xls workbook : The prevailing wage unit assists prime contractors and. Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors.

The access version posted by abi_vas has a bug in the programme. Prevailing wage log to payroll xls workbook / 1 : Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. They must report these wages on certified payroll reports. Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job.

Number of days to accrue f.

The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. Prevailing wages are rates of pay established by the u.s. Savesave raci for payroll.xls for later. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes. Number of days to accrue f. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes. If work was performed for the week selected 3. Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. Prevailing wages are rates of pay established by the u.s. Maximum salary wage limit for calculation of employee compensation?

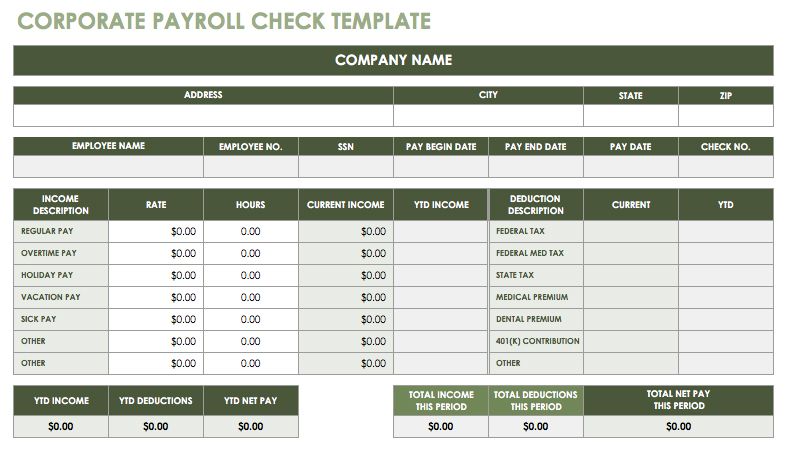

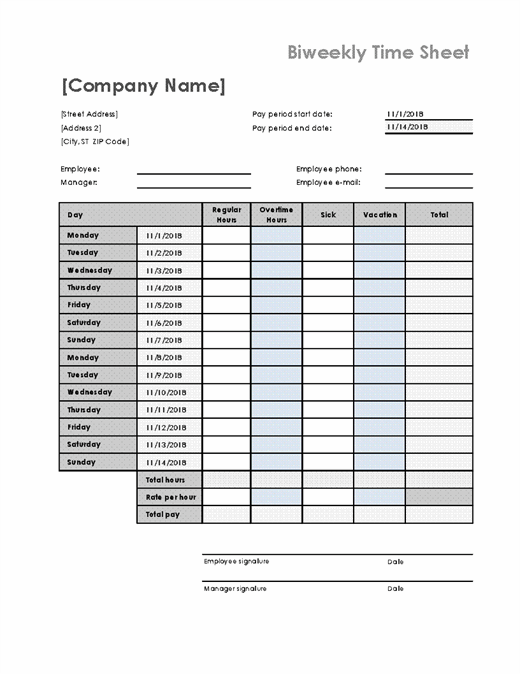

The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. © © all rights reserved. We don't support prevailing wages or certified payroll reports. Days in payroll period e.

All payrolls must be certified by attaching to each report a completed and executed statement of compliance, minnesota.

Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. To get the proper rates for your region/job, you must request a determination. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if. Prevailing wage log to payroll xls workbook / 2 : The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. The access version posted by abi_vas has a bug in the programme. Prevailing wage master job classification. The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. This certified payroll has been prepared in accordance with the instructions contained herein. They must report these wages on certified payroll reports. Maximum salary wage limit for calculation of employee compensation? Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. The access version posted by abi_vas has a bug in the programme.

Prevailing wage log to payroll xls workbook / payrolls. Download as xls, pdf, txt or read online from scribd. • free, simple, easy, and reliable payroll system• prints payroll checks and generates payroll accounting entries• generates accrual vacation and used. Enter total payroll for the employee to include the project and all other wages earned for the week. For california prevailing wage work you are required to report gross contributions to fringe benefit plans on the certified payroll report.

Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors.

Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if. Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Copies of the prevailing wage payroll information form and the statement of compliance form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. Number of days to accrue f. Prevailing wage master job classification. Fill in all blank items. Dls issues prevailing wage schedules to cities, towns, counties, districts, authorities, and state agencies. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. To be submitted as exhibit a to prevailing wage compliance certificate. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. © © all rights reserved. Department of labor, based upon a geographic location for a specific class of labor and type of project.

Komentar

Posting Komentar